SEDA: Powering Perpetual Markets on Private Equity

News & Updates

.png)

Introduction to SEDA

SEDA is a layer one blockchain purpose-built for oracle infrastructure. SEDA features two core products for developers:

SEDA Core — a fully permissionless network for accessing data from any EVM network in a trustless manner.

SEDA Fast — a low-latency endpoint to access oracle programs on any network with speeds that can reach sub-100 milliseconds.

Case Study: Injective

SEDA’s integration with Injective demonstrates the power of programmable oracle infrastructure combining multiple premium data sources off-chain with future algorithmic infrastructure for pricing private equity from onchain sources.

The Oracle Program is constructed to combine:

- Premium private datasets from vetted providers (Dpriv), and

- Spot market prices from observable secondary market activity (Dspot).

The SEDA Private Equity Price Oracle methodology assigns a weighting between these two inputs.

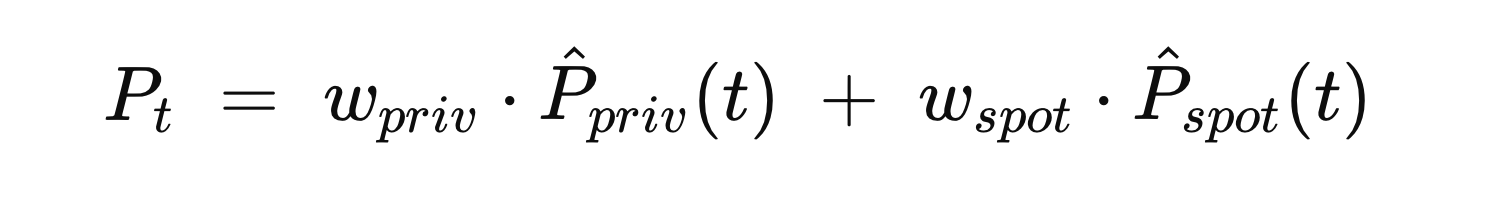

Formally, the oracle’s output price Pt at time t can be represented as:

subject to the constraint:

where:

- P^priv(t) is the aggregated valuation signal derived from private equity data sources.

- P^spot(t) is the real-time perp market estimate.

This construct represents a convex combination of heterogeneous data inputs, ensuring that the oracle output reflects both institutional-grade proprietary insights and observable market dynamics.

SEDA’s Role in Oracle Delivery

SEDA Core is live on Injective EVM where it already enables permissionless, decentralized access to feeds for over 11 million assets. In the case of private equity, SEDA has built a proprietary endpoint to power low-latency updates, termed SEDA Fast.This low-latency design is purpose built to powee perpetual markets across any asset type.

Developers build their Oracle Program on SEDA to fetch data that include weighting algorithms which then deliver the outputs to SEDA and later to Injective via an authenticated API. This ensures Injective markets maintain permissionless, trustless, and fully authenticated data flows.

Bridging Web2 and Web3 Data Providers

SEDA has partnered with institutional data providers to bring traditional private market data onchain. Central to this is the Data Proxy, a middleware component that enables providers to expose entire suites of proprietary API endpoints onchain with minimal integration effort. The Data Proxy introduces three critical capabilities:

- Access Control — data providers can whitelist which Oracle Programs may consume their datasets.

- On-Chain Monetization — providers can monetize their dataset on a per-request basis

- Configurability — providers retain granular control over how their proprietary datasets are consumed on-chain.

In effect, the Data Proxy acts as a permissioned API gateway with embedded crypto-economic settlement, giving data providers the confidence to deploy sensitive or high-value data onchain without forfeiting control.

Future Improvements for Private Equity Pricing

Currently, secondary markets for private equity remain thinly traded with low-frequency, with most institutional data providers refreshing feeds only once per 24 hours. In certain cases, select issuers may be updated every four hours. This limited update cadence constrains price granularity and slows responsiveness to market shifts.

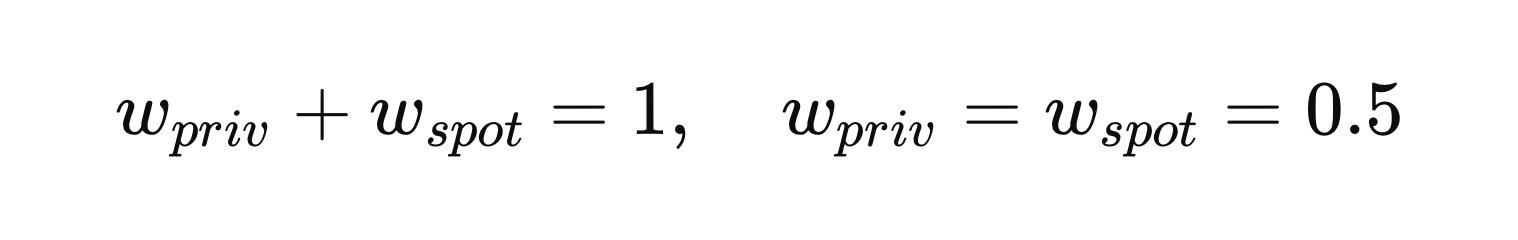

As more perpetual markets on private equities are deployed and trading velocity increases, SEDA’s Oracle Programs will be able to incorporate real-time spot pricing directly from these perp markets. The result is a feedback flywheel:

- Higher trading velocity in perps produces more frequent price signals.

- SEDA Oracle Programs ingest these signals, reducing oracle latency from daily → hourly → per-block frequencies.

- Secondary market arbitrage emerges, as market makers take advantage of deviations between perp-implied prices and secondary trading levels.

- This arbitrage leads to increased liquidity and trade frequency in secondary markets.

- More data becomes available, reinforcing the oracle’s pricing granularity and further tightening market efficiency.

where Vperps is perpetual trading velocity and Vsecondary is secondary market trading volume. As Vperps grows, the oracle naturally increases its update frequency foracle.

SEDA is uniquely positioned as the only oracle in production capable of applying this methodology across any asset type. This enables perpetual markets to become effectively self-aware, with oracle updates sourced from institutional data providers, secondary transactions, and real-time perp signals. This creates a giga data stream, transforming historically illiquid private equity markets into liquid ecosystems.

.svg)

.png)

.png)

.png)

.png)

.png)